CALGARY, July 6, 2017 /CNW/ - Paramount Resources Ltd. (TSX: POU) ("Paramount" or the "Company") is pleased to announce that it has entered into an agreement with certain subsidiaries of Apache Corporation to acquire Apache Canada Ltd. ("Apache Canada") for $459.5 million, plus working capital and other monetary adjustments (the "Apache Canada Acquisition"). Paramount plans to fund the Apache Canada Acquisition with cash on hand and no debt will be assumed.

Paramount has also entered into an agreement with Trilogy Energy Corp. ("Trilogy") to merge by way of an arrangement under the Business Corporations Act (Alberta), pursuant to which Paramount would acquire all of the common shares and non-voting shares of Trilogy not already owned by Paramount in exchange for Class A common shares of Paramount on the basis of one Paramount share for every 3.75 Trilogy shares (the "Merger").

These strategic transactions are the next steps in Paramount's transformation following the sale of the Company's Musreau deep cut gas processing plant and properties in 2016 and the repayment of all debt then outstanding. The Company is redeploying its cash on hand and immediately increasing its production, cash flows, reserves and landholdings.

Paramount, upon acquiring Apache Canada and merging with Trilogy, will become a Montney, Duvernay and Deep Basin focused intermediate exploration and production company with the financial strength to accelerate the development of a portfolio of top-tier resource plays, unlocking the value of the underlying resources. The integration of the three companies will generate operational synergies, optimize cost structures, offer financial flexibility and provide economies of scale. Paramount's diversified production base will be capable of delivering repeatable, low risk growth and generating free cash flow in a variety of price environments.

Once completed, the Apache Canada Acquisition and the Merger will result in Paramount having:

- Combined fourth quarter 2017 production expected to exceed 90,000 Boe/d, including approximately 35 percent liquids, and proved plus probable reserves of 600 MMBoe, based on independent reserves evaluations prepared by McDaniel & Associates Consultants Ltd. ("McDaniel") effective as of June 1, 2017;

- A total land position of approximately 2.7 million net acres with a number of top-tier Montney and Duvernay resource development plays which will provide the Company with considerable capital allocation flexibility;

- A strong balance sheet and materially enhanced cash flow base;

- Montney acreage of approximately 372,000 net acres, with near-term production growth focused at Karr and a new turn-key resource play at Wapiti which is anticipated to add material new production in mid-2019;

- Duvernay acreage of approximately 223,000 net acres, with near-term growth planned for the Kaybob Duvernay; and

- 176,000 net acres of fee simple lands in southern Alberta and additional minor properties, all of which may be monetized in whole or in part.

"These transactions represent Paramount's next significant resource capture, building on the transformation of the Company we initiated in 2016. We have replaced more than the liquids-rich Montney lands and reserves we sold in 2016 and acquired a suite of top-tier development opportunities," said Jim Riddell, Paramount's President and Chief Executive Officer.

"We believe the 46,000 Montney acres we are acquiring at Wapiti are a continuation of Paramount's liquids-rich resource play at Karr, where our drilling and completion programs have been delivering record results for Paramount. These transactions combine Trilogy's and Apache Canada's complementary land positions at Kaybob, materially increasing the size of those Montney and Duvernay resource plays.

"The combination of these three organizations will result in synergies in field operations, general and administrative expenses and development capital expenditures, as well as the optimization of processing and transportation infrastructure and commitments."

The Apache Canada Acquisition is not conditional on the completion of the Merger. Closing of the Apache Canada Acquisition is expected to occur in August 2017, subject to the receipt of regulatory approvals and other customary closing conditions. The Merger is conditional upon, among other things, the completion of the Apache Canada Acquisition and is targeted for completion in September 2017.

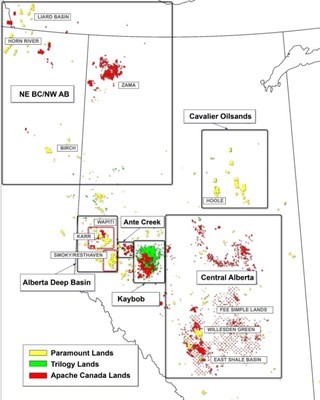

The map below outlines the location of Apache Canada's and Trilogy's lands in relation to Paramount's lands:

* Note: Apache Canada landholding information provided by Apache Canada.

Trilogy landholding information is from Trilogy's public disclosure documents.

Sales volumes and netbacks for Paramount, Apache Canada and Trilogy for the three months ended March 31, 2017 are as follows:

|

Paramount |

Apache Canada (1) |

Trilogy (2) |

Proforma | ||

|

Sales Volumes (Boe/d) |

16,163 |

42,196 |

25,133 |

83,492 | |

|

% liquids |

47% |

26% |

38% |

34% | |

|

Netback ($ millions) |

31.7 |

37.2 |

44.2 |

113.1 | |

|

(1) |

Sales volumes and netback information provided by Apache Canada. Excludes sales volumes and netbacks associated with Apache Canada's Midale, House Mountain and Provost properties, which have either been sold or are in the process of being sold by Apache Canada. | |||

|

(2) |

Sales volumes and netback information is from Trilogy's public disclosure documents. | |||

Reserves

Paramount's independent reserves evaluator, McDaniel, updated the Company's reserves evaluation to June 1, 2017. The Company's proved plus probable reserves increased 27 percent to 146 MMBoe compared to 115 MMBoe as of December 31, 2016. The increase in reserves is primarily due to the performance of new wells brought on production at the Karr property in 2017.

The reserves of Apache Canada and Trilogy have also been evaluated by McDaniel as of June 1, 2017. Estimated reserves volumes are summarized as follows:

|

Proved (1) | ||||

|

Paramount (2) |

Apache Canada (3) |

Trilogy |

Proforma | |

|

Natural Gas (Bcf) |

292.0 |

661.7 |

347.2 |

1,300.9 |

|

NGLs (MBbl) (4) |

33,959 |

54,968 |

19,531 |

108,457 |

|

Light and Medium Crude Oil (MBbl) |

771 |

2,943 |

15,837 |

19,551 |

|

Total (MBoe) |

83,400 |

168,193 |

93,238 |

344,832 |

|

See notes below. | ||||

|

Proved Plus Probable (1) | ||||

|

Paramount (2) |

Apache Canada (3) |

Trilogy |

Proforma | |

|

Natural Gas (Bcf) |

530.9 |

1,124.6 |

595.3 |

2,250.7 |

|

NGLs (MBbl) (4) |

56,798 |

97,129 |

40,218 |

194,145 |

|

Light and Medium Crude Oil (MBbl) |

1,098 |

3,760 |

25,629 |

30,487 |

|

Total (MBoe) |

146,377 |

288,320 |

165,059 |

599,757 |

|

(1) |

Reserves evaluated by McDaniel as of June 1, 2017. Volumes disclosed are working interest reserves before royalty deductions. Readers are referred to the advisories concerning Oil and Gas Measures and Definitions in the Advisories section of this news release. | ||||

|

(2) |

Paramount's reserves volumes exclude probable bitumen reserves related to the Company's oil sands properties. | ||||

|

(3) |

Excludes reserves volumes associated with Apache Canada's Midale, House Mountain and Provost properties, which have either been sold or are in the process of being sold by Apache Canada. | ||||

|

(4) |

NGLs means ethane, propane, butane, pentanes plus and condensate. | ||||

The following table summarizes the net present value of estimated future net revenue before tax of estimated reserves as at June 1, 2017:

|

Discounted at 10% (1)(2) | ||||

|

($ millions) |

Paramount (3) |

Apache |

Trilogy |

Proforma |

|

Total Proved |

757.9 |

1,137.7 |

835.9 |

2,731.5 |

|

Total Probable |

435.9 |

1,006.9 |

765.2 |

2,208.0 |

|

Total Proved plus Probable |

1,193.8 |

2,144.6 |

1,601.1 |

4,939.5 |

|

(1) |

Reserves evaluated by McDaniel as of June 1, 2017. Readers are referred to the advisories concerning Oil and Gas Measures and Definitions in the Advisories section of this news release. | |||

|

(2) |

The estimated net present values of future net revenue disclosed in this document do not represent fair market value. Revenues and expenditures were calculated based on McDaniel's forecast prices and costs as of April 1, 2017. | |||

|

(3) |

Excludes the Company's oil sands properties. | |||

|

(4) |

Excludes Apache Canada's Midale, House Mountain and Provost properties, which have either been sold or are in the process of being sold by Apache Canada. | |||

APACHE CANADA LTD.

Apache Canada is an indirect, wholly-owned subsidiary of Apache Corporation, a publicly traded U.S. based international oil and gas company. Highlights of the Apache Canada Acquisition include:

- Paramount is acquiring future Montney and Duvernay resource play opportunities in the Alberta Deep Basin, with production currently concentrated at Kaybob and Central Alberta;

- The acquisition of a turn-key Montney resource play at Wapiti, northwest of Paramount's Karr project, and 150 MMcf/d of gathering and processing capacity which a midstream owner/operator has committed to construct by mid-2019 and to which Paramount will have priority access with a take-or-pay commitment for a portion of the capacity;

- The addition of approximately 46,000 acres of undeveloped acreage at Wapiti with multiple intervals in the Montney formation which the Company plans to develop utilizing the well completion designs that have been successfully implemented by the Company at Karr;

- An increase in the Company's total acreage by approximately 1.6 million net acres, including highly prospective Montney and Duvernay undeveloped acreage of approximately 185,000 and 45,000 net acres, respectively; and

- The acquisition of approximately 176,000 net acres of fee simple lands in Central Alberta.

Apache Canada has recently sold its Midale and House Mountain properties and has entered into an agreement with another party to sell its Provost properties. These three properties are not part of the Apache Canada Acquisition.

Overview of Properties

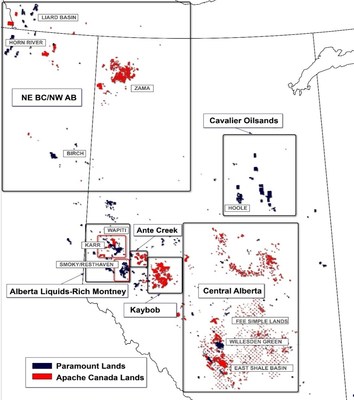

Apache Canada's primary developments are located at Wapiti, Kaybob/Ante Creek and Central Alberta.

* Note: Apache Canada landholding information provided by Apache Canada.

Alberta Liquids-Rich Montney - Wapiti

Apache Canada's Wapiti area includes approximately 46,000 (45,800 net) acres of Montney rights in the core of the over-pressured, liquids-rich fairway in the Alberta Deep Basin. Paramount is ready to commence a large-scale development of these resources and add new production in mid-2019 when a new third-party processing facility is completed (the "Wapiti Montney Project"). The Company plans to develop Wapiti utilizing the well completion designs that have been successfully executed at Paramount's Karr development. The Company expects Wapiti Montney Project natural gas volumes to increase to approximately 150 MMcf/d by 2021 as development proceeds and multi-well pads are completed and brought-on production.

The reserves evaluation for Apache Canada prepared by McDaniel includes 96 net undeveloped well locations for the Wapiti Montney Project, representing the development of approximately only 20 percent of the total Wapiti lands.

A midstream arrangement with a third-party owner/operator is in place for the turn-key Wapiti Montney Project. The first phase, scheduled for startup in mid-2019, includes 150 MMcf/d of sour gas processing capacity with acid gas injection capabilities and 25,000 Bbl/d of condensate processing capacity, as well as a gathering pipeline system and field compressor stations. Paramount will have priority access to the full 150 MMcf/d of capacity, with a take-or-pay commitment for a portion thereof. This gathering and processing arrangement allows Paramount to focus on drilling and completing wells while a third-party midstream operator concentrates on building and operating the infrastructure.

Firm-service natural gas transportation is also in place for the Wapiti Montney Project, with 50 MMcf/d of firm-service capacity available in mid-2019, which can be increased to 130 MMcf/d by 2020.

Kaybob/Ante Creek

The Kaybob/Ante Creek area includes approximately 490,000 (312,000 net) acres of land targeting liquids-rich natural gas production from the Duvernay, Montney and various Cretaceous horizons, including approximately 38,000 (24,000 net) acres of core Duvernay rights. Liquids-rich growth production will be processed through a third-party turn-key midstream solution with up to 100 MMcf/d of priority processing service. Production from the Kaybob area is for the three months ended March 31, 2017 was approximately 20,000 Boe/d, including approximately 20 percent liquids volumes.

Central Alberta

The Central Alberta area primarily consists of low-decline properties with resource development potential from the East Shale Basin Duvernay and the Glauconite, Cardium and Ellerslie formations. Apache Canada also owns approximately 176,000 net acres of fee simple lands in the Central Alberta region. Production for the three months ended March 31, 2017 was approximately 14,000 Boe/d, including approximately 38 percent liquids volumes.

Other Assets

Paramount plans to pro-actively manage the other Apache Canada assets acquired in the Northwest Territories, northeast British Columbia and northwest Alberta and explore opportunities to monetize the fee simple lands and certain other properties.

Operating Results

The following table summarizes Apache's Canada's operating results for the first quarter of 2017:

|

APACHE CANADA | ||

|

Three months ended March 31, 2017 | ||

|

Sales Volumes |

||

|

Natural Gas (MMcf/d) |

188.6 | |

|

Other NGLs (Bbl/d)(2) |

5,333 | |

|

Condensate and Oil (Bbl/d) |

5,437 | |

|

Total Sales Volumes (Boe/d) |

42,196 | |

|

% liquids |

26% | |

|

Netback ($ millions) |

$ 37.2 | |

|

(1) |

Operating information provided by Apache Canada. Excludes the results of the Midale, House Mountain and Provost properties, which have either been sold or are in the process of being sold by Apache Canada. |

|

(2) |

Other NGLs means ethane, propane and butane. |

Advisors

HSBC Securities (Canada) Inc. is acting as Paramount's exclusive financial advisor on the Apache Canada Acquisition. Norton Rose Fulbright is acting as the Company's legal advisor.

TRILOGY ENERGY CORP.

Trilogy is a petroleum and natural gas-focused Canadian energy corporation that actively develops, produces and sells natural gas, crude oil and natural gas liquids. Trilogy's geographically concentrated assets are primarily high working interest properties that provide abundant low-risk infill drilling opportunities and good access to infrastructure and processing facilities. Trilogy's common shares are listed on the Toronto Stock Exchange under the symbol "TET".

Overview of Properties

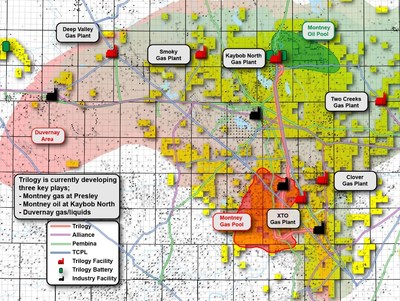

Trilogy's lands are primarily located in the Kaybob area, southeast of Grande Prairie, Alberta:

* Note: Trilogy landholding information is from Trilogy's public disclosure documents

Kaybob Montney Oil Pool

Trilogy discovered the Kaybob Montney oil pool in 2011 and owns approximately 32,000 net acres of land in the play. Approximately 125 wells have been drilled on the play to date. In its 2016/17 drilling program, Trilogy has tested increased proppant loading intensity with a slickwater fluid system, which has yielded results similar to the original wells drilled into the core of the pool.

Kaybob Presley Montney Gas

Trilogy's Presley Montney natural gas development includes approximately 38,000 net acres of land. Trilogy had drilled 82 horizontal wells on the play as of December 31, 2016.

Kaybob Duvernay

Trilogy holds approximately 118,000 net acres of Duvernay rights at Kaybob. The lands are strategically positioned in the core of the Duvernay, with offsetting operators initiating full-scale developments on adjacent lands. Multi-well pad development is expected to yield significant cost reductions relative to previous Duvernay wells.

Kaybob Infrastructure

In addition to its oil and gas resources, Trilogy owns a working interest in five gas plants, three major oil batteries plus an extensive gathering system in the Kaybob region.

The Merger

Paramount owns approximately 15% of the common shares and non-voting shares of Trilogy and Clayton H. Riddell is the principal shareholder and Chairman of both Paramount and Trilogy. The boards of directors of Paramount and Trilogy each established special committees of independent directors to consider and make a recommendation with respect to the Merger. The Paramount special committee engaged Peters & Co. Limited as its financial advisor and Burnet, Duckworth & Palmer LLP as its legal counsel to assist with its review. The Paramount and Trilogy special committees jointly engaged Deloitte LLP ("Deloitte") as independent valuator to provide certain financial advisory services in respect of the transaction, including the preparation of formal valuations of the Paramount shares and the Trilogy shares in accordance with Multilateral Instrument 61-101—Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Paramount and Trilogy special committees each recommended approval of the Merger to their respective boards of directors. Prior to making their recommendations, the special committees received from Deloitte its valuation conclusions for each of Paramount and Trilogy. In addition, the special committees were provided by Deloitte with a verbal opinion indicating that the proposed issuance by Paramount of one Paramount share for every 3.75 outstanding shares of Trilogy is fair, from a financial point of view, to the shareholders of both Paramount and Trilogy. Clayton H. Riddell has advised that he supports the Merger.

The Merger is subject to shareholder and court approvals, including the minority shareholder approval required by MI 61-101 by the shareholders of each of Paramount and Trilogy, and the fulfilment of other conditions that are typical for transactions of this nature. A joint information circular for the special meetings of shareholders of Paramount and Trilogy to consider the Merger is expected to be mailed in August 2017. The special meetings of shareholders are expected to be held in September. If all approvals are received, and other closing conditions satisfied, the Merger is expected to be completed in September 2017. The Arrangement Agreement will be filed on SEDAR (www.sedar.com).

Clayton H. Riddell will remain as Chairman and Jim Riddell will remain as President and Chief Executive Officer of Paramount following completion of the Merger. It is anticipated that the independent directors of Trilogy will become directors of Paramount upon completion of the Merger. The senior management of Paramount and Trilogy are all expected to be part of the Paramount management team following completion of the Merger.

Upon completion of the Merger, Paramount will have approximately 134.7 million shares outstanding (140.2 million shares on a fully diluted basis), based on the currently outstanding shares of Paramount and Trilogy, and Clayton H. Riddell will beneficially own or control, directly or indirectly, approximately 44% of the outstanding shares of the Company.

The outstanding high yield notes of Trilogy will remain outstanding following completion of the Merger. The Merger will not trigger any change of control payments. Following the Merger, the outstanding Trilogy options will entitle the holders to acquire Paramount shares rather than Trilogy shares, based on the exchange ratio for the Merger.

Advisors

Peters & Co. Limited is acting as financial advisor and Burnet, Duckworth & Palmer LLP is acting as legal advisor to the Paramount special committee. Raymond James Ltd. is acting as financial advisor and Stikeman Elliott LLP is acting as legal advisor to the Trilogy special committee. Norton Rose Fulbright is acting as company counsel for Paramount and Trilogy.

CREDIT FACILITY INCREASE

In connection with the annual review of Paramount's existing credit facility, the facility has been increased from $100 million to $300 million and the revolving term of the facility has been extended to April 30, 2018. It is anticipated that further amendments will be made to the facility following closing of the Apache Canada Acquisition and the Merger.

ABOUT PARAMOUNT

Paramount is an independent, publicly traded, Canadian energy company that explores and develops unconventional and conventional petroleum and natural gas prospects, including long-term unconventional exploration and pre-development projects, and holds a portfolio of investments in other entities. The Company's principal properties are primarily located in Alberta and British Columbia. Paramount's Class A common shares are listed on the Toronto Stock Exchange under the symbol "POU".

INVESTOR PRESENTATION

An investor presentation relating to these transactions will be posted on the Company's website (www.paramountres.com).

ADVISORIES

Forward-Looking Information

Certain statements in this news release constitute forward-looking information under applicable securities legislation. Forward-looking information typically contains statements with words such as "anticipate", "believe", "estimate", "will", "expect", "plan", "schedule", "intend", "propose", or similar words suggesting future outcomes or an outlook. Forward-looking information in this news release includes, but is not limited to:

- the anticipated closing of the Apache Canada Acquisition and the Merger, including satisfaction of closing conditions, receipt of regulatory, shareholder and court approvals and the timing thereof;

- the anticipated timing of the special meetings of shareholders which are being held to consider the Merger, and the mailing of the information circular in connection therewith;

- Paramount's assets, reserves (including increases thereto resulting from enhanced well performance) and the discounted present value of future net revenues therefrom, inventory of drilling locations, projected production levels (including decline rates and the liquids component thereof), anticipated growth in landholdings, and the increase in, and stabilization of, cash flows, all following the completion of the Apache Canada Acquisition and the Merger;

- the impact of the Apache Canada Acquisition and the Merger on the Company's financial position and strength, cost structures and strategy including the monetization of certain properties and its exploration, development and associated operational plans (including its drilling and completions program);

- the proforma operating and reserves information following the completion of the Apache Canada Acquisition and the Merger;

- the synergies, economies of scale and other benefits expected to be realized from the Apache Canada Acquisition and the Merger;

- anticipated third-party transportation and processing capacity;

- anticipated amendments to the Company's credit facility as a result of the Apache Canada Acquisition and the Merger;

- anticipated reductions in development costs in the Kaybob Duvernay resource play resulting from multi-well pad development; and

- general business strategies and objectives of Paramount.

In addition, information and statements herein relating to "reserves" are deemed to be forward looking information as they involve the implied assessment based on certain estimates and assumptions that the reserves described exist in the quantities predicted or estimated, and that the reserves can be profitably produced in the future.

Forward-looking information is based on a number of assumptions which may prove to be incorrect. Assumptions have been made with respect to the following matters, in addition to any other assumptions identified in this news release:

- the terms of the Apache Canada Acquisition and the Merger and the other matters disclosed herein in relation to the Apache Canada Acquisition and the Merger;

- the timely receipt of regulatory, shareholder and court approvals and satisfying closing conditions for the completion of the Apache Canada Acquisition and the Merger;

- the scope and effect of the expected benefits from the Apache Canada Acquisition and the Merger;

- future natural gas and liquids prices;

- royalty rates, taxes and capital, operating, general and administrative and other costs;

- foreign currency exchange rates and interest rates;

- general economic and business conditions;

- the ability of Paramount to obtain the required capital to finance its exploration, development and other operations and meet its commitments and financial obligations;

- the ability of Paramount to obtain equipment, services, supplies and personnel in a timely manner and at an acceptable cost to carry out its activities;

- the ability of Paramount to secure adequate product processing, transportation, de-ethanization, fractionation, and storage capacity on acceptable terms;

- the ability of Paramount to market its natural gas and liquids successfully to current and new customers;

- the ability of Paramount and its industry partners to obtain drilling success (including in respect of anticipated production volumes, reserves additions, liquids yields and resource recoveries) and operational improvements, efficiencies and results consistent with expectations;

- the timely receipt of required governmental and regulatory approvals;

- anticipated timelines and budgets being met in respect of drilling programs and other operations; and

- general business, economic and market conditions.

Although Paramount believes that the expectations reflected in such forward-looking information is reasonable, undue reliance should not be placed on it as Paramount can give no assurance that such expectations will prove to be correct. Forward-looking information is based on expectations, estimates and projections that involve a number of risks and uncertainties which could cause actual results to differ materially from those anticipated by Paramount and described in the forward-looking information. The material risks and uncertainties include, but are not limited to:

- the Apache Canada Acquisition and/or the Merger may not be completed on the terms anticipated or at all;

- the conditions to and approvals for the completion of the Apache Canada Acquisition and/or the Merger not being satisfied and obtained;

- the expected benefits of the Apache Canada Acquisition and/or the Merger not being realized;

- fluctuations in natural gas and liquids prices;

- changes in foreign currency exchange rates and interest rates;

- the uncertainty of estimates and projections relating to future revenue, future production, reserve additions, liquids yields (including condensate to natural gas ratios), resource recoveries, royalty rates, taxes and costs and expenses;

- the ability to secure adequate product processing, transportation, de-ethanization, fractionation, and storage capacity on acceptable terms;

- operational risks in exploring for, developing and producing natural gas and liquids;

- the ability to obtain equipment, services, supplies and personnel in a timely manner and at an acceptable cost;

- potential disruptions, delays or unexpected technical or other difficulties in designing, developing, expanding or operating new, expanded or existing facilities (including third-party facilities);

- processing, pipeline, de-ethanization and fractionation infrastructure outages, disruptions and constraints;

- risks and uncertainties involving the geology of oil and gas deposits;

- the uncertainty of reserves and resources estimates;

- general business, economic and market conditions;

- the ability to generate sufficient cash flow from operations and obtain financing to fund planned exploration, development and operational activities and meet current and future commitments and obligations (including product processing, transportation, de-ethanization, fractionation and similar commitments and debt obligations);

- changes in, or in the interpretation of, laws, regulations or policies (including environmental laws);

- the ability to obtain required governmental or regulatory approvals in a timely manner, and to enter into and maintain leases and licenses;

- the effects of weather;

- the timing and cost of future abandonment and reclamation obligations and potential liabilities for environmental damage and contamination;

- uncertainties regarding aboriginal claims and in maintaining relationships with local populations and other stakeholders;

- the outcome of existing and potential lawsuits, regulatory actions, audits and assessments; and

- other risks and uncertainties described elsewhere in this news release and in Paramount's other filings with Canadian securities authorities.

The foregoing list of risks is not exhaustive. For more information relating to risks, see the section titled "RISK FACTORS" in Paramount's current annual information form. The forward-looking information contained in this news release is made as of the date hereof and, except as required by applicable securities law, Paramount undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise.

Non-GAAP Measures

In this news release, "netback" and "free cash flow" (the "Non-GAAP Measures") are used and do not have a standardized meaning as prescribed by IFRS. Netback equals petroleum and natural gas sales less royalties, operating costs and transportation and NGLs processing costs. Netback is commonly used by management and investors to compare the results of the Company's oil and gas operations between periods. Free cash flow equals funds flow from operations minus maintenance capital and is used to measure whether net cash flows are positive or negative after deducting capital amounts incurred to maintain production at current levels. The calculation of free cash flow excludes capital amounts incurred to increase production and capital amounts incurred in prior periods.

Non-GAAP Measures should not be considered in isolation or construed as alternatives to their most directly comparable measure calculated in accordance with GAAP, or other measures of financial performance, calculated in accordance with GAAP. Non-GAAP Measures are unlikely to be comparable to similar measures presented by other issuers.

Oil and Gas Measures and Definitions

Abbreviations

|

Liquids |

Natural Gas |

|||

|

Bbl |

Barrels |

Mcf |

Thousands of cubic feet | |

|

MBbl |

Thousands of barrels |

Bcf |

Billions of cubic feet | |

|

Bbl/d |

Barrels per day |

MMcf/d |

Millions of cubic feet per day | |

|

NGLs |

Natural gas liquids |

|||

|

Condensate |

Pentane and heavier hydrocarbons |

|||

|

Oil Equivalent |

||||

|

Boe |

Barrels of oil equivalent |

|||

|

MBoe |

Thousands of barrels of oil equivalent |

|||

|

MMBoe |

Millions of barrels of oil equivalent |

|||

|

Boe/d |

Barrels of oil equivalent per day |

|||

Measures

This news release contains disclosures expressed in "Boe/d", "MBoe" and "MMBoe". Oil equivalency volumes have been derived using the ratio of six thousand cubic feet of natural gas to one barrel of oil. Equivalency measures may be misleading, particularly if used in isolation. A conversion ratio of six thousand cubic feet of natural gas to one barrel of oil is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the well head. The term "liquids" is used to represent oil, condensate and Other NGLs. The term "Other NGLs" means ethane, propane and butane.

During the three months ended March 31, 2017, the value ratio between crude oil and natural gas was approximately 23:1. This value ratio is significantly different from the energy equivalency ratio of 6:1. Using a 6:1 ratio would be misleading as an indication of value.

SOURCE Paramount Resources Ltd.